6 Exciting Ways to Recession-Proof Your Life! These smart strategies are perfect for both booming and challenging times!

- Stock Market Charlie

- Oct 18, 2025

- 6 min read

Key Takeaways

Before diving into any major financial decisions, take a moment to reflect on what's motivating you. Having a solid plan that prepares you for both the highs and lows can be incredibly comforting!

It's always smart to review your spending and saving habits. If you're feeling anxious about the future, boosting your emergency savings can ensure you have cash ready for any unexpected situations.

Stay committed to your investment strategy during stock market dips. Missing out on the best recovery days can impact your long-term success!

Keep your resume updated with your latest skills and achievements—you never know when opportunity might knock!

During challenging times, your financial plan's resilience can be tested in unexpected ways! This can stir up strong emotions, potentially complicating financial decisions. That's why it's always a fantastic idea to get ready for a recession before it surprises you again.

Economic uncertainty can heighten anxiety, especially when headlines and economic news seem bleak. But fear not! Here are 6 savvy steps you can take right now to manage your emotions and boost your finances.

1. Embrace mindfulness to make smarter money decisions

Our natural reactions aren't always the most helpful. "Some people disengage from their finances in down markets because they feel anxiety at the thought of knowing how bad their situation might be. Others, meanwhile, engage more in down markets, spurred by feelings of fear into behaviors like panic selling," says Brianna Middlewood, PhD, a director of behavioral research.

That's why it's crucial to keep your long-term goals in sight! If you find yourself checking out or tempted to cut your losses in the market despite a well-considered long-term investment plan, pause and reflect on what's truly driving your choice and if it aligns with your long-term interests. Embracing mindfulness can help you cultivate the discipline you need to steer clear of emotional money moves that you might regret later.

2. Get a Financial Plan or Supercharge the One You Have!

If you don't have a financial plan yet, now's the perfect time to create one and tweak it along the journey! A financial plan is your trusty companion, designed to guide you through the highs and lows of the market. It helps you understand your current financial position and provides a roadmap to a secure financial future. By planning, you can test how different market and economic scenarios might impact your financial health. For example, you can calculate how much you need to save to achieve your major goals if circumstances change.

"What concerns me are major system shocks—like a recession or job loss. It's crucial to ensure you have enough liquidity to navigate those times," says David Peterson. "With a plan, you can explore different scenarios. What if I'm laid off and out of work for 6 months? Where will the money come from to cover essential expenses? And how could it affect my retirement plan? A plan allows you to model these situations and estimate the impact of 6 months without income.”

It's all about finding the right balance—saving and investing for the future while protecting what you have today. By preparing early, you can ensure you have funds for unexpected expenses, a strategy to safeguard your assets, and the growth potential to achieve your long-term dreams.

3. Discover Ways to Spend Less or Earn More!

In the short term, finding extra money can be challenging. If it were easy, we'd all be doing it! So, cutting back on spending is the obvious choice when you're looking for extra cash to save or pay bills.

Start by examining your spending compared to your income. You don't need to track every penny, but having a general idea of your spending habits can help you make a start.

4. Boost Your Emergency Savings!

Emergency savings are a lifesaver during tough times! Begin by saving $1,000 and then keep going until you reach a level that makes you feel secure. Ideally, aim to save enough to cover 3 to 6 months of essential expenses. Some may even want to save more. Don't worry if your emergency savings aren't there yet; 3 months' worth of expenses is a significant amount, but with consistent monthly savings, you can gradually build up to it.

It makes sense to keep a good portion of your emergency savings liquid, so you can easily access it when needed. "It doesn't all have to be in cash, but consider low-risk investments like money market funds or CDs that you can rely on if you need access," says Peterson.

5. Stay the Course with Your Investments!

Investing for the long term requires faith that the future will be bright. Though market volatility can be unsettling, it's a normal part of the stock market's rhythm.

Trade-offs in the Stock Market

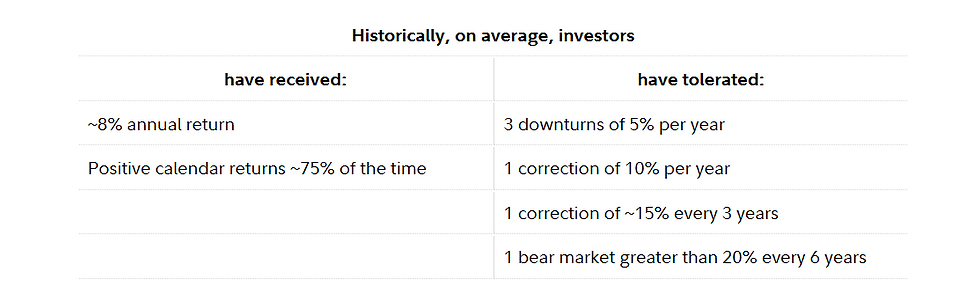

Exciting news! Historically, the stock market has had more up years than down years! While stock prices don't shoot straight up forever, and might dip a few times each year, that's all part of the thrilling ride. Corrections of up to 15% may happen every few years, and occasionally, the market might drop more than 20%. These events are rare but not entirely unheard of. A dip of more than 10% but less than 20% is called a correction, while a drop of at least 20% from the market's high point to its low is known as a bear market.

The best part? Historically, the stock market has bounced back with positive returns after significant corrections and bear markets. That's why sticking to your investment plan through the market's ups and downs can be a fantastic strategy!

Median returns following large stock market selloffs (1950–2022)

Get excited about your investment journey! Since no one can predict exactly when the market will shift, staying committed to your investment plan has proven to be a winning strategy over trying to time your exits and re-entries. Just missing a handful of the best market days could significantly impact your long-term returns!

Imagine the potential growth of $10,000 invested in the S&P 500 Index from January 1, 1988, to December 31, 2024!

6. Update Your Resume and Sharpen Your Skills

While economic growth might be slowing, there's an exciting silver lining: the labor market is still buzzing with opportunities! As of September 3, 2025, there are an impressive 7.2 million jobs available, even though that's a slight dip from last year.2

Whether you're worried about potential layoffs or simply eager for a new adventure, giving your resume a fresh update with your latest skills and achievements ensures you're ready to seize any opportunity!

Thrive During Tough Financial Times

The perfect time to prepare for any financial challenge is when things are going smoothly. Remember, nothing is permanent. Bull markets will eventually pause, and bear markets will pass; economic expansions may slow, but growth will always reignite. To kickstart your financial strategy or enhance your existing plan, consider teaming up with a financial professional.

Best Regards.

Stock Market Charlie

_edited_edited.jpg)

Comments