DeFi Development Corp has granted me stock warrants. By: Stock Market Charlie

- Stock Market Charlie

- Oct 28, 2025

- 5 min read

Greetings readers of Black Investors Coalition. Today, I'm excited to share one of my personal investments outside of BIC that I believe holds significant promise for the future. I'm focusing on DeFi Development Corp, which serves as the Treasury for Cryptocurrency Solana, a project that has garnered considerable attention within the blockchain community for its innovative approach and scalability. In this article, I will delve into the specifics of the shares I own of DFDV, the stock warrants issued to me today for holding DFDV, and the substantial amount of Solana I've acquired as part of my investment strategy. Furthermore, I plan to significantly increase my Solana holdings by the year 2026, aligning with my long-term vision for wealth accumulation in the burgeoning cryptocurrency market. As an investor, it's crucial that we are always on the lookout for undervalued companies that have the potential to grow and develop, much like Nvidia has done in the tech sector over the years. Nvidia has become a powerhouse in the field of graphics processing units and artificial intelligence, and I believe that in DFDV, I have discovered a comparable opportunity that could help grow my personal wealth in the coming years. To elaborate further, my current holdings in DFDV are not just a mere speculation; they represent a calculated investment in a company that is strategically positioned within the DeFi landscape. The stock warrants I received today are particularly exciting, as they provide me with the option to purchase additional shares at a predetermined price, allowing me to capitalize on future growth while minimizing risk. This mechanism is a testament to my confidence in DFDV’s potential to expand and thrive in the competitive cryptocurrency space. Moreover, the Solana blockchain has been making waves due to its high throughput and low transaction costs, making it an attractive option for developers and users alike. My decision to acquire a significant amount of Solana is rooted in my belief that this cryptocurrency will continue to gain traction and utility over the next few years. With the DeFi sector rapidly evolving, I anticipate that Solana will play a pivotal role in shaping the future of finance, and I want to ensure that I am well-positioned to benefit from this transformation. As I look ahead to 2026, my intention to increase my Solana holdings is driven by a thorough analysis of market trends and the overall trajectory of the cryptocurrency industry. I believe that by strategically investing in both DFDV and Solana, I can create a robust portfolio that will not only withstand market fluctuations but also thrive as the industry matures. The intersection of decentralized finance and traditional investment strategies is where I see the greatest potential for growth, and I am excited to be part of this journey. In conclusion, I invite you all to consider the opportunities that lie within the DeFi space and to think critically about your own investment strategies. Just as Nvidia has transformed the tech landscape, I am confident that DeFi Development Corp will emerge as a key player in the cryptocurrency realm, and I am eager to share my experiences and insights with you as we navigate this dynamic market together.

DeFi Development Corp has granted me stock warrants, reflecting their confidence in my contributions and the significance of innovative financial solutions in today's market. Stock warrants allow the holder to buy company shares at a set price before expiration, incentivizing investment in the company's growth, especially in the dynamic DeFi field. This strategic move aligns my interests with the company's, fostering ownership and commitment to drive innovation. This approach is crucial in DeFi, where collaboration and shared vision are essential. The stock warrants represent both a financial opportunity and a deeper engagement with DeFi Development Corp's mission to revolutionize finance through decentralized solutions, aligning with my commitment to transparency, security, and accessibility in financial systems. This practice is part of a broader DeFi trend to incentivize key contributors and foster shared success, enhancing organizational resilience in volatile cryptocurrency markets. The granting of stock warrants marks a pivotal moment in my professional journey, aligning individual contributions with organizational goals and paving the

DeFi Development Corp. (Nasdaq: DFDV) is the pioneering Digital Asset Treasury (DAT) specifically created to accumulate and compound Solana (SOL).

Through the utilization of capital markets, validator operations, on-chain innovation, and strategic partnerships, we strive to provide market participants with the optimal method for compounding their SOL exposure.

As the DeFi space evolves, I am eager to explore future opportunities through this partnership.

ABOUT DEFI DEVELOPMENT CORP

Exciting Mission of DeFi Development Corp

DeFi Development Corp is on a thrilling mission to revolutionize the DeFi landscape! They're all about crafting powerful, secure, and scalable solutions that transform how financial services are accessed and utilized worldwide. The company is dedicated to developing cutting-edge decentralized applications (dApps) that promise seamless interoperability and outstanding user experiences. Their exciting vision is to dismantle the barriers of traditional finance by delivering innovative DeFi solutions that empower individuals and communities. They're committed to building a decentralized financial infrastructure that is efficient, transparent, and trustworthy, setting the stage for a more inclusive global economy!

DeFi Development Corp. is the (Nasdaq: DFDV) first Digital Asset Treasury (DAT) explicitly designed to accumulate and compound Solana (SOL).

By leveraging capital markets, validator operations, onchain innovation, and strategic partnerships, we aim to offer market participants the best way to compound their SOL exposure.

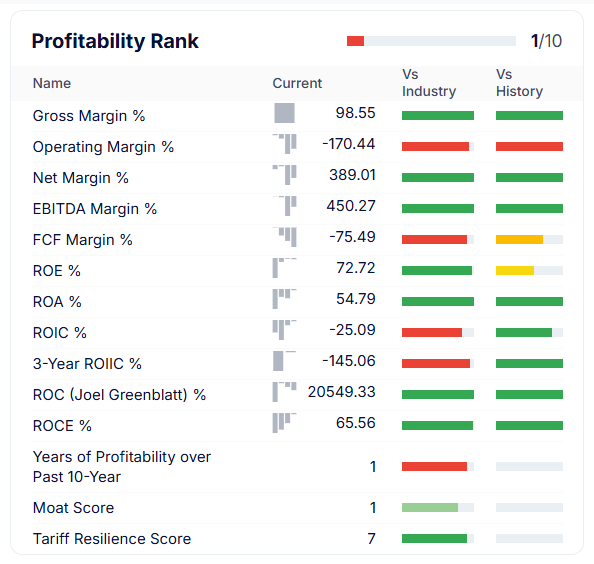

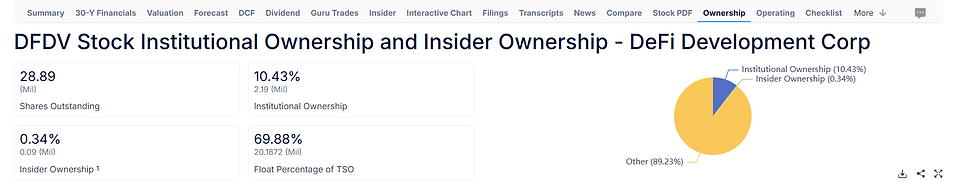

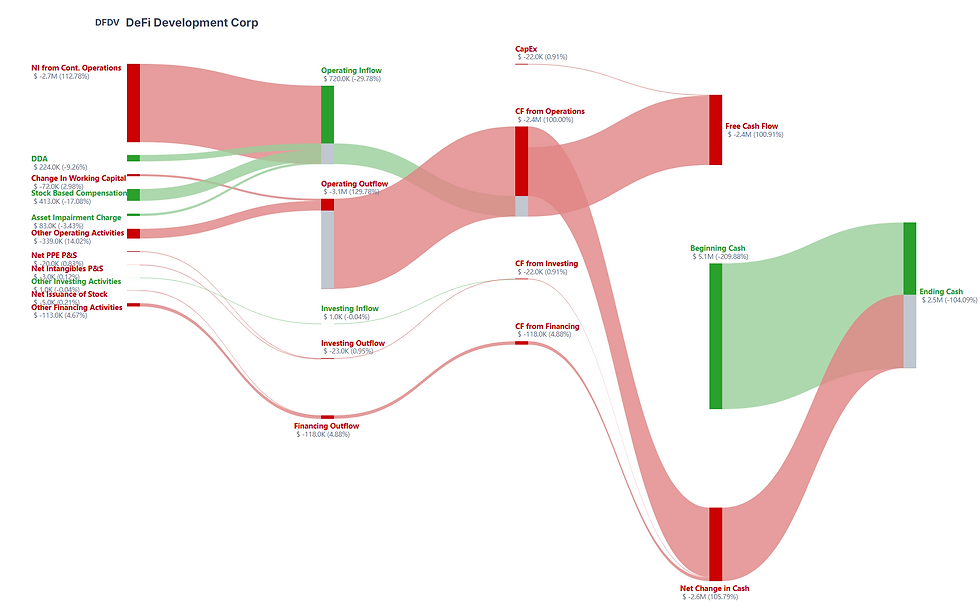

DeFi Development Corp Financial Statements

Best Regards,

Stock Market Charlie

_edited_edited.jpg)

Comments