Thrilling Earnings Season: Key Reports and Market Impacts By: Stock Market Charlie

- Stock Market Charlie

- Oct 26, 2025

- 5 min read

The third-quarter earnings season is kicking into high gear with an action-packed week ahead! Get ready for exciting earnings reports from five of the Magnificent 7 and Warren Buffett’s own Berkshire Hathaway (BRK/A, BRK/B). A whopping 173 S&P 500 companies are set to unveil their results. Among the big names to watch are Boeing (BA), Kraft Heinz (KHC), ServiceNow (NOW), Merck (MRK), Mastercard (MA), Chevron (CVX), and Exxon Mobil (XOM).

So far, 29% of companies have reported, and an impressive 86% have surpassed consensus earnings estimates.

Earnings At A Glance

Exciting news! The S&P 500's blended earnings growth rate for the quarter has soared to an impressive 9.2% year-over-year, surpassing the anticipated 7.9% at the quarter's end. Looking ahead, the expected earnings growth rate for the calendar years 2025 and 2026 remains strong at 11.0% and 13.9%, respectively. Let's keep this momentum going!

Market Performance

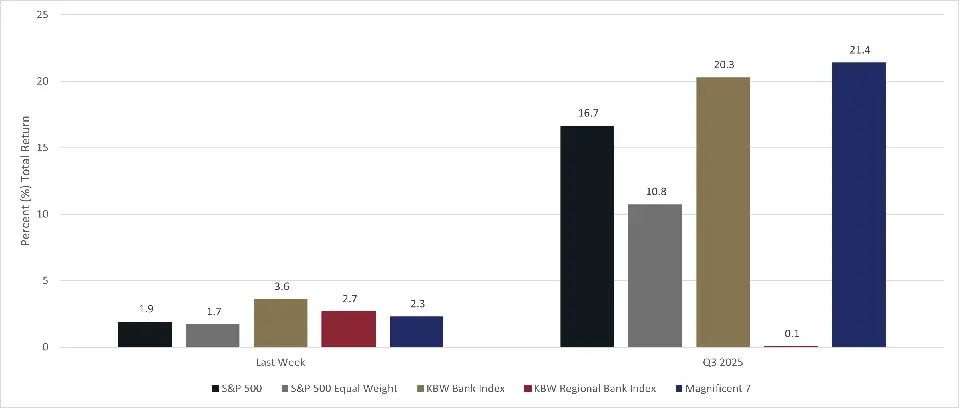

Exciting news as the strong earnings season continues to boost the S&P 500! The Magnificent 7, featuring Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and Tesla (TSLA), shined brightly last week with outstanding performance!

Moreover, a better-than-expected consumer inflation reading has paved the way for a potential Federal Reserve rate cut this week, providing an extra boost to stocks, especially in the banking sector. The absence of additional “cockroaches” last week allowed regional banks to bounce back from worries over reported loan fraud. What a thrilling turnaround!

Magnificent 7

These powerhouse companies are the key drivers of earnings growth and hold a substantial chunk of the S&P 500’s market capitalization. The Magnificent 7 is the group to keep an eye on this earnings season! Last week, Tesla (TSLA) fell short of expectations and was the only member of the Magnificent 7 to experience a dip in stock price.

This week is thrilling as five of the Magnificent 7 are set to report earnings: Alphabet (GOOGL), Meta Platforms (META), and Microsoft (MSFT) will unveil their results after the close on Wednesday; while Apple (AAPL) and Amazon.com (AMZN) will follow suit after the close on Thursday.

Earnings Insights By Sector

Exciting news from the latest FactSet data! Companies in the financials, information technology, and industrials sectors delivered impressive positive earnings surprises, driving a remarkable boost in the S&P 500’s earnings growth rate last week.

In the financial sector, Capital One Financial (COF) and Chubb (CB) were standout performers, driving significant positive momentum! Over in technology, Intel (INTC) delivered an exciting positive surprise, while RTX (RTX) and GE Aerospace (GE) shone brightly in the industrials sector with their impressive surprises.

Revenue Results By Sector

Sales growth is thrillingly linked to nominal GDP growth, which combines real GDP growth with inflation. If the third-quarter nominal year-over-year GDP growth estimate of 4.8% holds true, there might be some downside to expected sales growth. However, with sales growth soaring at 7.0%, it's far exceeding expectations! This earnings season, the consumer discretionary and financials sectors have been the key players, driving remarkable sales growth improvements.

Inflation

Exciting news! The government shutdown may have delayed the September consumer inflation (CPI) readings, but the results are in, and they are fantastic! Both the headline and core figures, excluding food and energy, surpassed expectations. The headline and core CPI saw a 3% year-over-year increase, which is more favorable than anticipated, despite worries about tariff-induced price pressures. Even better, the details bring more good news, as the pace of price gains for services and housing is slowing down. The 3-month annualized rate of CPI growth remained steady, hinting that the recent inflation acceleration could be easing. What a relief!

What To Watch This Week

Get ready for an exciting week as the earnings season hits its peak! Despite the ongoing government shutdown delaying many US economic releases, all eyes are on the busiest week yet. Five of the Magnificent 7 companies are reporting earnings, and they play a crucial role in shaping the S&P 500’s expected earnings growth rate. These reports are key indicators for the booming artificial intelligence sector and the tech industry at large.

Even with challenges like the government shutdown, tariffs, and a cooling labor market, the economy is standing strong! The odds of a US recession in 2025 have dropped to just 4%. Plus, President Trump is set to meet with China’s President Xi this week, stirring anticipation for improved relations between the countries, even if a complete trade deal isn't on the horizon just yet.

Exciting news from last week: the encouraging inflation data has paved the way for another 25 basis point (0.25%) rate cut from the Federal Reserve (Fed) at their meeting on Wednesday! Financial markets are buzzing with anticipation for another cut at the December meeting.

With the added economic visibility challenges from the government shutdown, all eyes will be on management’s forward earnings guidance! The Fed rate cut is practically guaranteed, making Chair Powell’s insights on the future path of monetary policy a must-watch event. While he might not take a strong stance due to uncertainties in the labor market's health, he’s expected to align with the anticipation of another Fed easing in December. Get ready for some exciting developments!

Best Regards,

Stock Market Charlie

_edited_edited.jpg)

Comments